Contents

ToggleIt’s a little bit crazy that, despite this blog getting close to its second birthday, I’ve never sit down to write an epic frugal living post tips.

My use of the word “epic” there is only half meant as a mockery of those who overuse said word. Because while I try to avoid clichés, this site definitely needs a mega frugal living tips post.

I mean, we’d all like to have a little bit more cash, right? Just like Smash Mouth once said, in their infinite wisdom, “we could all use a little change!”

And so, this post will be my ultimate frugal living guide to help you get a little extra change in your pockets.

Sure, making money online can sometimes be an even better way to improve your finances, but sometimes, saving money is just easier.

These days, so many people are looking for ways to save more money and live frugally. Dollar stores are increasingly becoming a staple as people look to stretch their pennies further.

If that sounds like you, then you are probably always looking for new ways to save money. And that’s what this post is all about. If you want to start living frugally, you need these ideas in your life.

So, what are the best ways to put frugal living into practice? That’s what we’ll cover here. With these frugal living tips, you can save money and reach your financial goals!

Why Do You Need Frugal Living Tips?

In the internet age, pretty much everything gets criticized in some form or another. I feel like you could save a puppy’s life and, nowadays, someone would still find something wrong with it.

That’s why, at a certain point, you have to ignore what people say or think and just do what’s best for you. If what you are doing makes you happy, then why does it really matter what anyone else thinks?

That is especially true for random people online.

For me, frugal living is not the same as being cheap. See, I consider frugal living to be similar to intentional living.

I often say I rarely buy things on an impulse, and that’s because I don’t. I often think for days, weeks, or even months if I really need that thing.

Of course, how long I think about it is in direct correlation to the price of the thing. But even then, I won’t spend $1 on something I have no need for. If I don’t need it, I don’t buy it!

Frugal living tips are important because they allow you to take control over your own personal finance. It can help you spend less, live a frugal life, and focus only on the things you really need.

But rather than being constantly at the mercy of a paycheck, you’ll be able to make financial decisions based on what you what.

And that is definitely important. That’s why you need my best frugal living tips!

Is Frugal Living Good or Bad?

Here’s a question: why does it have to be one way or the other?

I know humans like to feel validated by “fellow” humans, but what is so wrong with doing something because it’s what’s best for you?

Nay, I don’t believe frugal living is inherently good or bad. Frugality is a choice.

If you live in a country where you just so happen to have that choice, you should feel lucky! Not everyone enjoys such liberties.

My advice is to stop worrying about whether frugality is good or bad and to just do what works for you.

Doesn’t work for your neighbor, or your friend, or your in-laws? Who cares!? If it improves your quality of life, that’s all that really matters.

With that said, let’s dive right into my best frugal living tips!

1. Save Money by Getting Free Gift Cards

One of the best (and easiest) ways to save money is by getting free gift cards. One way to do so is by completing surveys, but that is not the only way.

For instance, you can use apps that pay you to walk or get rewarded just for shopping online. And sites like Rakuten will reward you for shopping online by giving you cash back on your purchases.

Survey Junkie

You probably won’t make a full-time income or anything like that, but this can be a nice way to earn a few extra dollars.

And all you have to do is give your opinion on things you already buy. Pretty simple, huh?

Survey Junkie is definitely a great way to earn extra money. But don’t take my word for it. It scores an excellent ratings of 4.5/5 from Trust Pilot, 4.3/5 from Google Play, and 4.5/5 from the Apple Store.

Read our Survey Junkie review to learn more.

2. Trim Unnecessary Expenses To Exercise Frugal Living

Common areas include recurring subscriptions, your cell phone bill, and other utilities.

Monitor Your Credit With CreditKarma

In case you hadn’t heard, improving you credit score can actually save you money.

How? Well, if you ever need to finance a purchase, you’re likely to have a lower interest rate if your credit score is better.

While you can check your credit score for free at Annual Credit Report, you can only check it once per year. However, if you sign up for Credit Karma, you’ll be able to check your credit score once per week!

That can really come in handy if you have a large purchase coming up, such as a house or a car.

3. Negotiate Prices When Possible

Negotiating prices is always a good idea because you have nothing to lose. Sure, it oftentimes won’t be possible, but it doesn’t hurt to ask.

Remember – no one is ever going to say no to your money (other than extreme cases).

However, assuming you’re a reasonable buyer, the worst thing that can happen is the seller says they aren’t able to negotiate.

I often talk about the “big three expenses” – your housing, transportation, and food. While you probably can’t negotiate your food prices (let me know if you can!), you can usually negotiate the other two.

How To Negotiate

While there are many ways to negotiate, my favorite way is a simple, but effective strategy. If I am the buyer, I will offer to pay less than I’m hoping to pay.

For a simple example, let’s say I’m buying a car with a $20,000 sticker price. If I’d like to pay $18,000 for the car, I might offer to pay $16,000.

Why? Because counter-offers are usually common in negotiation.

If I’m lucky, the dealer might offer the car at $18,000 – or he might even offer it for less!

However, if I had offered $18,000, the dealer might counter-offer with a $19,000 price. If that happens, I have little to no chance of getting the car for the price I wanted.

While this tactic doesn’t always work, it’s always worth trying.

4. Frugal Living Tips: Have a Plan When Grocery Shopping

Having a plan when grocery shopping is always a good idea. Not having a plan when you shop can not only result in spending more money, it can also lead to buying less healthy food.

The grocery store is actually laid out in a very specific way. For example, dairy and eggs are usually at the back of the store because people often go to the store specifically to buy those particular items.

There are also other things, like impulse buys such as sodas and candy bars at the front of the store. This is done very much intentionally in hopes you’ll buy them on a whim.

This illustrates the importance of having a list and sticking to it. By doing so, you’ll not only save money, you’ll also avoid buying those unhealthy impulse buys.

5. Use Ibotta To Get Cash Back On Groceries

6. Buy Used Items Instead of New

- Thrift Stores

- Craigslist

- eBay

- Facebook Marketplace

- Garage Sales/Estate Sales/Flea Markets

Most electronics aren’t moving as fast as they used to, which means buying last year’s model isn’t so bad. The biggest drawback to buying used is probably availability.

When buying used, you can’t always go out and buy exactly what you want. Instead, you sometimes have to be on the lookout for things you may want, and you may or may not always be successful in finding it.

It depends on what you’re buying, though. If you’re buying something popular, such as an iPhone, it will be easy to find last year’s model on eBay.

7. Take Advantage of Your Local Library

If you live anywhere near a library, you should definitely be taking advantage of it! Libraries are a fantastic resource if you’re trying to find ways to spend less.

If you don’t have a library card, you should get one ASAP.

Plus, if you use free books apps, you can also make the decision to avoid physically visiting the library if you prefer that.

However you decide to get your dose of reading, using your local library will definitely help you life a more frugal life.

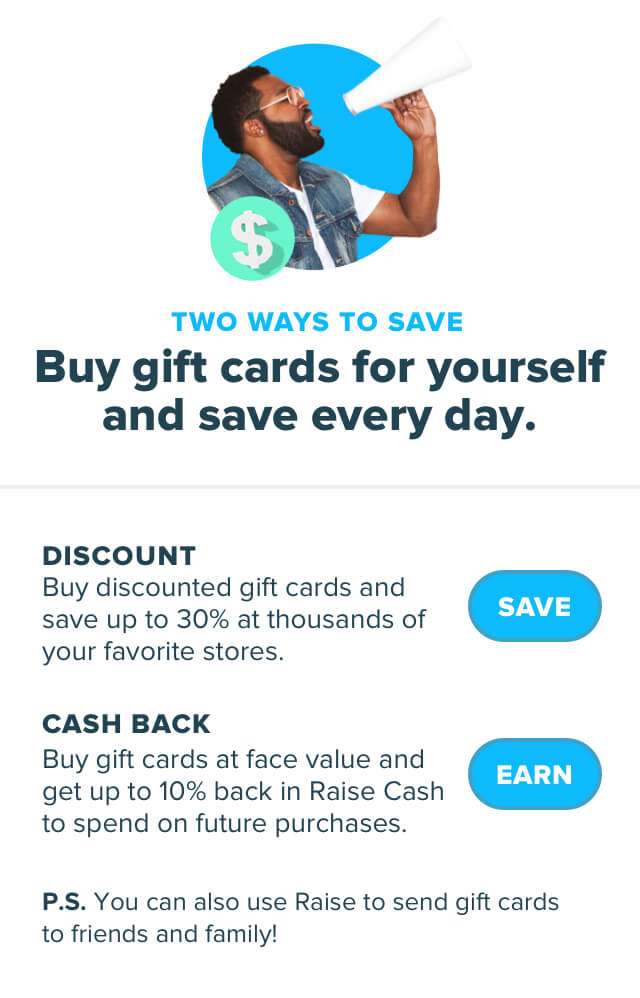

8. Buy Discounted Gift Cards on Raise

Did you know there are sites where people actually sell gift cards for less than their face value? It’s true. Sites like Raise let you buy and sell gift cards, and oftentimes you can get them at a discount!

Sound too good to be true? It’s not, if you think about it. It’s easy to understand, especially if you celebrate the holidays.

Sometimes people get gift cards for stores they never visit. Or, sometimes, people are just in a pinch and need to sell something to get quick cash.

Whatever the case may be, Raise can help you save money on places you would have shopped anyway.

As an added bonus, if you’re working on a credit card sign-up bonus, you can use this trick to help meet your minimum spend. Sometimes, you gotta be creative.

Join Raise now to start saving!

9. Cut Back on Meat Consumption

I realize this isn’t something many people want to hear and that the US (among other countries) sees meat as non-negotiable, but that simply isn’t true.

And notice how I didn’t say “eliminate” meat consumption. Less is generally more, but that doesn’t mean you have to eliminate meat completely. Any amount of reduction is going to benefit your budget.

What most people worry about when cutting out meat consumption is protein. But there are plenty of non-meat sources of protein, and they are just about always cheaper. These include eggs, cheese, tofu, beans and rice, and quinoa.

Not only are these sources of protein cheaper, but they can be healthier, too. Plus, they are better for the environment. Save money, be healthier, and reduce your environmental impact. Win, win, win!

10. Look for Restaurants with Discounted Kids Menus

If you have a large family, home-cooked meals are almost certainly the cheapest option. However, that won’t always be realistic.

If you find yourself eating at a restaurant with the kids, look for the kids menu. It will always be cheaper, and kids eat free at some restaurants.

11. Buy Store-Brand Products When Possible

Opting for the store brand is one of my favorite ways to save money. This of course applies mostly to grocery shopping. While it’s true that not every generic item is going to be the same, many of them are.

For example, I usually find that things such as store-brand cereal and medication are no different than their brand-name counterparts.

On the other hand, I have found other items, such as toilet paper, tend to be lower quality when buying the store brand. In other words, there is a trial-and-error process of finding which store-brand items are the same as brand-name.

12. Earn Cash Back with Dollar Dig

Sign up for Dollar Dig and get $2.50 just for joining!

13. Frugal Living Means Avoiding the “Upgrade Cycle”

But that simply isn’t the case anymore. This is not to say devices aren’t still improving, but there is no longer a drastic improvement from one version to the next.

14. Buy Frozen Produce and Avoid Pre-Cut

Another easy way to save money is to buy frozen produce. Frozen foods are often stigmatized as if they are somehow inferior, but the reality is that that just isn’t true.

You might notice advertising campaigns such as Wendy’s “fresh, never frozen” trucks. Fresh is good, but there’s nothing wrong with frozen!

It mostly depends upon how quickly you plan on using it. If you plan on using it right away, there’s no need for frozen. But anything that might take more than a few days to use up would be good to buy frozen.

When it comes to fruit, stores will usually charge more for pre-cut fruit. While convenience can be nice, pre-cut is more expensive, and there isn’t much work to be done there.

Next time you see these things, don’t just buy whatever is in front of you. Be intentional about how you spend your money!

15. Re-Purpose Items That Are No Longer Good

16. Get Rid of Things You Can’t Salvage

While I advocate for reusing items when possible, and just buying less in general, I realize that isn’t always possible.

Obviously, there are going to be some things you will never reuse, like used toilet paper (ick!).

But even then, you might have other things that aren’t necessarily disposable, but no longer need them – nor can you find another use.

To use the electronics example again (since they can still become outdated quickly), say you have an old pair of desktop speakers. Those may not be easy to re-purpose – so what do you do with them?

Rather than simply throwing them in the trash, I would recommend letting someone else get a second use out of them.

But since this post is about improving your finances, don’t just give them away. Instead, use an app like Declutrr and earn a bit for your items. Every little bit helps!

17. Take a Hike

Literally. In our consumerist society, everyone thinks you have to go to the bar or the movies or a restaurant all the time.

While there is nothing wrong with doing so, it seems we sometimes forgot how much we can do while spending very little.

But getting outdoors can not only be cheaper – it can also be a great source of exercise. Not to mention being therapeutic and a great way to “unplug.”

Of course, it’s easier to do things outside during the warmer months, but there are so many outdoor activities that don’t cost a dime.

Others may cost a bit up front, but cost little to nothing on an ongoing basis.

Think about it:

- Hiking

- Bike riding

- Play a game of catch

- Go camping

These are just a few ideas, and I’m sure you can find plenty of lists with hundreds of them. But you get the idea.

18. Always Have An Emergency Fund

Stuff happens. Cars break down. Health issues come up. People lose jobs.

While we may like to think these things will never happen, they are unfortunately inevitable. And it’s better to be prepared than just hope for the best.

That’s where an emergency fund can help. Having 6-8 months of expenses saved will help insulate you from these inevitable issues.

That may sound like a lot, but you don’t have to save it all at once. Instead, save a little bit each time you get paid until you have enough.

And don’t just put that money in a regular bank account. I prefer a high-yield savings account such as Ally’s Online Savings Account.

Quick Summary of Frugal Living Tips

Whew! That was a lot! Let’s quickly recap all of those frugal living tips.

1. Save money by getting free gift cards – getting free gift cards is a great way to save money.

2. Trim unnecessary expenses – use Trim to lower or even totally eliminate certain expenses.

3. Negotiate prices when possible – such as when buying a house or a car.

4. Have a plan when grocery shopping – don’t just buy random items. Have a list and stick to it.

5. Use Ibotta to get cash back on groceries – if you’re going to buy groceries, you may as well use Ibotta to get cash back on them.

6. Buy used items instead of new – there are countless items you can find used. Where possible, look for used before considering new.

7. Use your local library – this is a great free resource.

8. Buy discounted gift cards on Raise – Raise lets you buy them for places you were already going to spend money.

9. Cut back on meat consumption – like it or not, meat is expensive. Opting for planet-based alternatives is cheaper, plain and simple.

10. Look for restaurants with discounted kids menus – or if kids eat free, even better!

11. Buy store brand products when possible – store-brand groceries are always cheaper – often at the same quality as brand-name.

12. Earn cash back with Dollar Dig – Dollar Dig lets you buy thousands of items you already buy and earn cash back on them.

13. Avoid the “upgrade cycle” – we’re constantly pressured to upgrade to new devices when the ones we have are totally fine. Just don’t.

14. Buy frozen produce and avoid pre-cut – frozen is cheaper; pre-cut isn’t. But there’s nothing wrong with frozen foods. Buy frozen if you won’t use it right away.

15. Re-purpose items that are no longer good – there are lots of ways to re-purpose old items. Get creative!

16. Get rid of things you can’t salvage – if you can’t get rid of it, consider using an app like Decluttr rather than just throwing it out.

17. Take a hike – do something outdoors, rather than indoors, to avoid overspending on entertainment.

18. Always have an emergency fund – stuff happens. It’s better to be prepared when it does.

If you want to start saving money and live a more frugal lifestyle, these frugal tips should put you on your way! What are your favorite frugal living tips?

Let us know in the comments what frugal living tips you have.

Pingback: TrueFees

I’d like to find out more? I’d want to find out more details.